Ready to start?

Barrie drivers can save an average of $300 on insurance with BIG.

Unlock the Best Car Insurance in Barrie

Barrie’s well-connected streets and highways make it easy to reach popular spots like the Barrie Waterfront, Sunnidale Park, and Horseshoe Valley. With easy access to Highway 400, Dunlop Street, and Mapleview Drive, commuting and travelling around the city is smooth and efficient. From exploring the downtown core to visiting nearby attractions, driving in Barrie offers convenience and adventure at every turn.

Wherever the road takes you, having reliable auto insurance is essential. A BIG car insurance broker in Barrie can offer expert advice and tailor coverage to meet your specific needs and budget, allowing you to drive with peace of mind.

Join the Hundreds of Thousands Who Have Trusted BIG

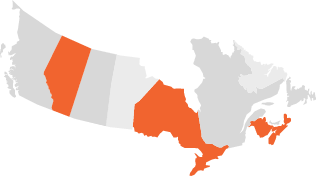

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Barrie.

Access to a Large Array of Trusted Insurance Providers

How to Buy Car Insurance in Barrie

Get the best car insurance in Barrie by following these three easy steps:

Fill Out Our Quote Form

You can request a quote for car insurance in Barrie by providing us with details like your postal code, vehicle specifications, driving record, and insurance history. This will help us find the best insurance tailored to your situation.

Customize Your Coverage

One of our brokers in Barrie will reach out to discuss your coverage needs, helping you choose appropriate deductible options and reviewing policy limits and exclusions to ensure you have the proper protection in place.

Secure Your Policy

Once you’ve finalized your policy, review and sign your digital insurance application to lock in your personalized insurance policy.

Find a Barrie Insurance Brokerage Near You

Barrie

80 Bradford Street. Suite #300, Unit 150

Barrie, ON L4N 6S7

FAQs About Barrie Auto Insurance

The price of insurance is different for everyone and is calculated based on the following:

- The type of car you drive

- Your marital status, age, and gender

- Where you live

- How often you drive

- Your driving record and insurance history

Yes, having a valid auto insurance policy is a legal requirement to drive. Driving without insurance can result in heavy fines, licence suspension, and in some cases, vehicle impoundment. It’s crucial to ensure you're adequately insured before hitting the road.

Barrie car insurance rates tend to be affordable. However, various factors are taken into consideration to determine your premiums. It's always a good idea to compare quotes from multiple providers to find the best rate for your situation.

To compare car insurance quotes in Barrie, simply visit thebig.ca and enter your details. In just a few minutes, you'll be presented with the best rates from BIG's network of insurance providers, making it easy to find the right coverage for your needs.

Yes, you can request a quote for auto insurance in Barrie before purchasing a vehicle. By providing details such as the year, make, and model of the cars you're considering, you'll be able to estimate insurance costs and factor them into your decision before buying the car.

When requesting an auto insurance quote in Barrie, you will need to provide:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of licence

- Licence dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, licence suspensions

- Any insurance cancellations

- Your contact information so our Barrie car insurance brokers can reach you

To get the best price for auto insurance in Barrie, it's important to explore several options and take advantage of cost-saving opportunities that don't compromise coverage. Here are a few strategies to help lower your premiums:

- Work with a broker for personalized advice

- Bundle your home and auto insurance

- Install winter tires

- Maintain a clean driving record

- Reduce your annual mileage, if possible

- Ask about available discounts to ensure you're getting the most competitive rate without sacrificing coverage

Once you’ve selected your car insurance policy, our team will promptly prepare paperwork for you to review and sign so you can hit the roads of Barrie.

What is Factored in When Determining the Price of Auto Insurance in Barrie?

Determining the price of auto insurance in Barrie involves several critical factors. Insurers evaluate the level of risk associated with insuring you and the likelihood of you filing a claim. When requesting a quote through BIG, it’s essential to be transparent with your information to avoid gaps in your coverage or complications when filing a claim

Where you live significantly impacts your auto insurance rates. Insurance providers assess local risk factors such as crime rates, vehicle thefts, and instances of vandalism. If you reside in an area with higher risks, you may face elevated premiums.

Factors such as your age, gender, and marital status play a significant role in determining your insurance rates. Younger drivers, especially those under 25, often incur higher premiums due to their perceived risk. Additionally, insurers may consider gender, with males historically facing higher rates, though this trend is changing. Married individuals often benefit from lower premiums, as they are statistically seen as more responsible drivers.

Your driving history is crucial in shaping your insurance rates. A clean driving record, free from accidents or traffic violations, typically leads to lower premiums. In contrast, a history of tickets or accidents can classify you as a higher risk, resulting in increased costs.

Insurers assess your past claims to determine the level of risk you present. A history of frequent or costly claims can lead to higher premiums, as it indicates a greater likelihood of future claims. Conversely, having no claims on your record may qualify you for lower rates.

The make, model, and age of your vehicle significantly influence your insurance rates. Newer, high-value cars often have higher premiums due to increased replacement costs and higher repair expenses. Conversely, older and less expensive vehicles generally attract more affordable rates.

The frequency and purpose of your vehicle use are important considerations for insurance rates. Higher usage, especially for commuting long distances, typically results in increased risk exposure and consequently higher premiums. If you drive less frequently, your rates may be lower due to a reduced chance of accidents.

The type of coverage you select also affects your premiums. Opting for comprehensive coverage, which includes protection against theft, vandalism, and other risks, will generally increase your rates. In contrast, choosing only the minimum required coverage can result in lower premiums but may leave you unprotected in certain instances. Additional coverage options, such as higher liability limits or collision coverage, will lead to increased costs but provide added peace of mind.

Get the Best Car Insurance in Barrie for Less!

Looking to secure affordable and reliable car insurance in Barrie? You’re in the right place. Follow these six simple tips to ensure you get the best coverage at a price that fits your budget.

Work With a BIG broker in Barrie

Consulting with a knowledgeable BIG broker in Barrie is the first step toward finding the right policy. With their extensive knowledge of the insurance market, a BIG broker will help tailor your coverage, ensuring there are no gaps and that you're getting the most competitive rates available.

Bundle Your Insurance Policies

Maximizing savings is easy when you bundle your home and auto insurance. By combining these policies with the same provider, you can unlock discounts of up to 20%, saving you money and simplifying your insurance management.

Install Winter Tires

Barrie’s cold winters make winter tires essential for safe driving. Many insurance companies offer discounts to drivers who install these tires, as they improve vehicle safety in snow and icy conditions. Ask your broker about this potential discount during the winter months.

Drive Safely

This is one of the most effective ways to ensure affordable rates over time, as insurance companies reward responsible driving with lower premiums. By maintaining a clean driving record, free of traffic violations or accidents, you’ll show insurers you’re a safe driver – helping you save on car insurance.

Explore Available Discounts

Whether you’re a loyal policyholder, a new driver, or part of an alumni association, you may be eligible for additional discounts. A BIG auto insurance broker in Barrie will work with you to identify any savings opportunities you qualify for, ensuring you’re not missing out on any available reductions.

Reduce Your Driving Distance

Driving less lowers your risk of accidents and can lead to reduced insurance rates. If possible, consider alternative transportation options such as walking, cycling, or using public transit to lower your annual mileage and keep your premiums in check.

The Latest

Check out our latest blog posts on all things auto insurance…