Ready to start?

Burlington drivers can save an average of $300 on insurance with BIG.

Affordable Car Insurance in Burlington

Burlington is a bustling city that is home to plenty of drivers. Plus, the city attracts many visitors with its beautiful waterfront views, artsy shopping districts, and cultural events. These bustling Burlington streets lead to a higher frequency of car insurance claims compared to less populated areas in Ontario.

Everyone deserves affordable car insurance! Whether you’re a stay-at-home parent taking advantage of Central Park’s amenities, a retiree cruising along Lakeshore Drive, or a results-oriented business owner commuting on the 403, you shouldn’t have to overpay for auto insurance in Burlington. BIG offers the best car insurance in Burlington at the best price.

Join the Hundreds of Thousands Who Have Trusted BIG

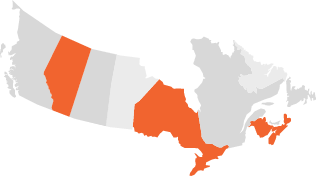

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Burlington.

Access to a Large Array of Trusted Insurance Providers

How to Get a Burlington Car Insurance Quote

Get a car insurance quote in 3 easy steps.

Introduce Yourself

The 3-minute process is completely confidential. Share your postal code and a few details about your car and driving experience, and presto! You will see the top car insurance quotes in Burlington.

Customize Your Coverage

One of our car insurance brokers in Burlington will reach out to discuss your rates and recommend the best options. You’re in the driver’s seat now…choose your deductibles, limits, and coverages that suit your needs.

Sign & Start Your Engine

Ready to start saving? Your digital insurance application will be sent to your smartphone or computer. Sign online with just one click of the mouse or tap of your finger and drive off into the sunset.

Find a Burlington Insurance Brokerage Near You

Burlington East

5311 John Lucas Dr,

Unit 200 Burlington, ON L7L 6A8

Burlington West

7A-760 Brant Street

Burlington, ON L7S 1X7

Burlington Auto Insurance FAQs

Auto insurance in Burlington is dependent on many factors that are unique to your situation, including:

- Personal Information: age, gender, marital status, address

- Driving Experience: years licensed, years insured, claims, cancellations, tickets, suspensions.

- Vehicle Information: year, make, model, safety features

- Vehicle Usage: annual kilometres, commuting distance, parking arrangements.

Car insurance is mandatory in Burlington after the Compulsory Automobile Insurance Act was passed in 1990. The law requires a basic minimum amount of coverage for all drivers. It’s intended to protect all drivers and victims. Mandatory car insurance guarantees that you are financially protected if another driver’s actions lead to your vehicle being totalled or cause an accident that forces you to take time off work to recover from an injury.

This is somewhat true. Car insurance in Burlington is less expensive than in Richmond Hill, Brampton, or Ajax. Cities with larger populations, like Burlington, have more road traffic, leading to more claims than a smaller community.

The driver plays a major factor in the cost of insurance. Someone with a pristine insurance history and driving record will receive a much better price than a driver with multiple at-fault accidents, a cancellation for non-payment, or a speeding ticket.

You can compare quotes directly on our website for free. In just 3 minutes, you can see the top companies offering the best car insurance in Burlington. It’s really that easy!

Yes! Luckily, you don’t need a VIN to get an auto insurance quote. Just fill out the year, make, and model of the vehicle you are considering, and we will find affordable car insurance quotes in Burlington for you.

Here is what you will need to get a quote for car insurance in Burlington:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of license

- License dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, license suspensions

- Any insurance cancellations

- Your contact information so our Burlington car insurance brokers can reach you

So, you’re looking to save as much as possible on your car insurance – we don’t blame you! There are certainly options for getting affordable auto insurance quotes in Burlington, but just remember, paying less is not always best. Without collision and comprehensive coverage on your policy, repair costs could ‘ding’ your finances later. Or, is it really worth paying thousands of dollars for a rental while your car is getting fixed? Definitely not. Some things are just worth it. That said, BIG has the most competitive prices out there. We can save you hundreds of dollars on your insurance.

- Here are some strategies to get lower rates on car insurance:

- Use an insurance broker

- Bundle your property and car policies

- Get winter tires

It takes literally 3 minutes to get a quote on our website! Give us a couple of minutes to process your paperwork, sign on the dotted line, and you’re ready for the roads.

Factors that Determine Burlington Auto Insurance Rates

There are many details that play into determining your insurance rates. Some things you can control, other things you can’t. It’s all about how much risk you present to an insurer. That’s why a broker can be so helpful in getting you a great price. Always provide honest, accurate information when you request an auto insurance quote in Burlington; otherwise, you might not be covered in a claim.

Your location matters! If your neighbourhood sees more vehicle theft and vandalism, it’s more expensive for insurers to cover the costs. That’s why sometimes they charge more. They also predict the probability of collisions in your area based on traffic patterns, and claims data. If you live in the L7P postal code, you’re in a high-risk area for theft, vandalism, or accidents. Expect to pay a bit more than your family member who has an L7T postal code.

Your age, gender, and marital status all help determine your car insurance cost. Young drivers are more likely to be in an accident because they have less experience. Male drivers typically pay more than females because they are known to take more risks, drive more aggressively, and get into accidents more often. Some carriers offer unique rates for non-binary individuals (must have Gender X on driver’s license). Marital status only comes into play with some companies and discounts are based on trends they see in their claims data.

For the most part, the more driving experience you have, the better a driver you are. More experience makes you eligible for cheaper rates. Your experience is calculated from the date you receive your most current license class in Ontario (G2 or G). Keep your driving record clear of traffic tickets for speeding, running a stop-sign, or driving while intoxicated. Why? Traffic tickets and license suspensions can increase your Burlington auto insurance significantly.

Your claims history is a major factor in determining auto insurance in Burlington. If you’re at fault for any accidents, your premiums will be higher than someone with a clean driving record. “What if I wasn’t at fault?” you say? Don’t worry, those rarely affect insurance rates. If you have multiple claims or accidents on your record, your insurance provider may require you have a higher deductible.

Yep, the type of car you drive affects your Burlington car insurance quote. If your vehicle is more expensive to fix or replace, or is statistically targeted for theft, you can expect to pay more for insurance. On the other hand, your vehicle’s safety features could reduce the risk of injury claims or collisions, which may lower your insurance costs.

How you use your vehicle will impact your Burlington auto insurance. Stats show drivers are more likely to make a claim when they have high annual mileage or a long commute. You might qualify for a discount if you have private parking arrangements. Using your vehicle for business reasons (e.g., food delivery, transporting clients) might require special coverage.

The type of coverage you choose is up to you. It depends on your level of comfort, eligibility, and risk tolerance. Mandatory coverage in Ontario includes Liability, Uninsured Motorist, and Accident Benefits. From there, you can talk with a BIG broker to decide what’s best for your vehicle and situation – and trust us – we have options! Choose deductibles for collision and comprehensive, add rental car coverage or an accident forgiveness, or increase your liability and accident benefits.

How Can I Pay Less on Car Insurance in Burlington?

Getting affordable car insurance in Burlington is absolutely possible! And you don’t have to compromise on reliable coverage. Whether getting to and from work in Uptown Burlington, running errands at the Mapleview Mall, or spending time at Spencer Smith Park, you can drive with peace of mind with the following tips.

Use BIG Burlington Car Insurance Brokers!

A car insurance broker in Burlington can find incredible savings for you! How? They have access to multiple insurance companies and rates. After comparing Burlington auto insurance quotes, they will offer you the most competitive options for your situation. Say goodbye to wasted time – we’ll take it from here.

Bundle Your Home & Auto

If you want to save on car insurance in Burlington, combine your car and property policies for a major discount. On average, you can save 15%-20%! Your property insurance might even pay for itself, and you get even better protection.

Get Winter Tires

Ice, snow, and slush are things you learn to deal with in Canada. Installing winter tires on your car will reward you with a discount on your auto insurance. Plus, you will be better equipped to handle your vehicle on those slippery streets. Unless you’re moving to sunnier shores, winter tires are a win-win.

Ask About Discounts

In insurance, there’s a discount for just about everything. Does your partner have a separate policy? Combine your policies for a multi-vehicle discount! Did you take driver training? You can save money there, too! We might even honour your loyalty discount when you switch to us. Retirees, good students, experienced drivers, and electric car owners all catch a break. Just ask a BIG broker if you qualify for any discounts.

Be a Safe Driver

Safe drivers are simply the best! Save up to 30% on your car insurance on a telematics program. Safe drivers know the rules of the road…and follow them. Keep your record squeaky clean to keep your auto insurance rates low.

Drive Less

You have to get to your destination, but is driving your car the best way? Maybe work is within walking distance, or you can get around town with public transit. Could you cut your commute by hopping on the GO Train, carpooling, or working remotely? With lower annual mileage, you can keep your auto insurance rates affordable.

The Latest

Check out our latest blog posts on all things auto insurance…