Ready to start?

Guelph drivers can save an average of $300 on insurance with BIG.

Driving in Guelph

Often called “The Royal City”, Guelph is known for its rich history, vibrant culture, and picturesque landscapes. With a strong sense of community and thriving local businesses, Guelph attracts drivers who enjoy a balance of urban life and green spaces. Whether you're cruising through downtown’s historic streets, taking in the scenic views of the Speed River, or commuting along Highway 6 towards Toronto, having the right car insurance in Guelph is essential.

At Billyard Insurance Group (BIG), we make it easy to find affordable car insurance quotes that are tailored to your needs. From the busy corridors of Stone Road Mall to the quiet neighbourhoods near the University of Guelph, a BIG broker will ensure you’re protected wherever the road takes you. Request an online insurance quote for Guelph today!

Join the Hundreds of Thousands Who Have Trusted BIG

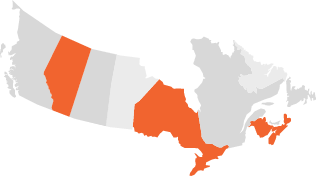

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Guelph.

Access to a Large Array of Trusted Insurance Providers

How to Purchase Personalized Car Insurance in Guelph

Follow these simple steps to request a quote for car insurance in Guelph:

Enter Your Personal Information

Provide key details such as your postal code, vehicle type, driving record, and insurance history. This information helps us find the best car insurance in Guelph.

Personalize Your Coverage

A BIG car insurance broker in Guelph will reach out to review your quotes, discuss your preferences, and customize your policy by exploring deductible options, coverage limits, and any additional protection you may need.

Secure Your Insurance Policy

Once you're satisfied with your policy details, simply sign your digital application. You’ll then be ready to drive through Guelph’s streets with peace of mind knowing that your car insurance has you covered.

Find a Guelph Insurance Brokerage Near You

Guelph

7-3 Watson Rd. S.

Guelph, ON N1L 1E3

Common Questions About Guelph Auto Insurance

Auto insurance rates in Guelph vary based on several personal factors, such as:

- Your age, gender, and marital status

- The type of vehicle you drive

- How frequently and how far you drive

- Where in Guelph you live

- Your driving record and insurance history

Yes, driving without valid auto insurance in Guelph is illegal. You are required by Ontario law to have insurance to drive. If caught driving without coverage, you could face hefty fines, licence suspension, and other legal consequences. You would also be responsible for covering any damages or injuries in the event of an accident.

Guelph tends to have moderate auto insurance rates compared to larger cities in Ontario. However, your specific premium will depend on your individual profile and driving history. To ensure you're getting the best rate, it's a good idea to shop around and compare quotes.

Request a quote online from BIG, and within minutes, you’ll get details on the best available rates. If you need guidance on selecting the right policy, feel free to reach out to a BIG broker for expert assistance!

Yes, you can request a quote even if you haven’t purchased a vehicle. By providing information about the cars you're considering, you can plan for potential insurance costs and budget accordingly before buying a car.

To receive an auto insurance quote for Guelph, you’ll need the following details:

- Postal code

- Vehicle information: year, make, model, winter tires status, and ownership details (leased, financed, or owned)

- Driver information: name, gender, marital status, birthdate, licence class, years insured, claims history, tickets, and any insurance cancellations

There are several ways to save on car insurance premiums in Guelph, including:

- Shopping around for quotes

- Bundling your home and auto insurance

- Installing winter tires

- Maintaining a clean driving record

- Reducing your annual mileage

- Asking about available discounts

Once you’ve finalized your policy and completed the required paperwork, your coverage will begin soon after. This quick process will ensure you have coverage as soon as possible.

What Influences the Cost of Car Insurance in Guelph?

Understanding the factors that influence car insurance rates in Guelph can help you find the most affordable coverage. Insurance providers assess various elements to determine your premiums, including your individual risk profile, the characteristics of your vehicle, and your driving history.

Your residential area in Guelph plays a crucial role in determining your auto insurance premiums. If you live in a bustling neighbourhood with high traffic congestion or a history of vehicle-related crimes, you may see higher rates. Conversely, residing in quieter, low-traffic areas typically leads to more favorable insurance rates, as the likelihood of accidents and theft is reduced.

Factors such as age, gender, and marital status are significant in shaping your car insurance premiums. Young drivers often face higher rates due to the perceived risk associated with their age group. Male drivers might have higher premiums as well. Additionally, married individuals often enjoy lower rates, as insurers tend to view them as more responsible drivers.

Maintaining a clean driving record is one of the best ways to keep your auto insurance costs down. A record free from accidents and traffic violations demonstrates responsible driving, which can lead to lower premiums. However, if you have a history of accidents or infractions, insurers may classify you as a higher-risk driver, resulting in increased rates.

Insurance companies evaluate your claims history to gauge potential risks. Frequent claims, especially those where you were at fault, can lead to higher premiums. In contrast, having a minimal claims history often works in your favour, potentially lowering your overall costs.

The make, model, and age of your vehicle also play a pivotal role in determining your insurance rates. Newer, high-performance cars may incur higher premiums due to increased theft risks and costly repairs. Conversely, older models or vehicles known for safety and reliability can result in lower insurance costs, as they often cost less to repair and are less likely to be stolen.

Your car's usage significantly impacts your insurance rates. Higher annual mileage, particularly for long commutes or frequent trips, may lead to increased premiums due to a higher likelihood of accidents. However, if you primarily use your vehicle for occasional outings, this can positively influence your insurance costs.

Choosing the right coverage is essential for balancing adequate protection with affordability. Working with a BIG broker allows you to customize your policy to meet your specific needs, whether that means adjusting deductibles or adding options like collision coverage or rental car protection.

Start Saving on Car Insurance in Guelph

Whether you're driving to the University of Guelph for classes or exploring the scenic Riverside Park, having the right auto insurance can give you peace of mind. Here are some practical tips to help you save on your premiums and enjoy a safer driving experience

Connect With a Guelph Broker

A BIG broker in Guelph can provide personalized advice and ensure you have the best coverage without gaps or overpayments. They have access to various insurance companies, helping you find competitive rates tailored to your needs.

Bundle Your Policies

Combining your car and home insurance can lead to substantial savings. With both policies under one provider, you'll enjoy the convenience of a single point of contact for any questions or claims.

Invest in Winter Tires

Equipping your vehicle with winter tires not only enhances safety during snowy conditions but may also lead to discounts on your insurance. This proactive step can reduce your risk of accidents during the winter months.

Practice Safe Driving

A clean driving record is key to reducing your premiums. Safe driving habits can demonstrate to insurers that you are a low-risk driver, potentially leading to discounts on your insurance costs.

Seek Available Discounts

Work with your BIG broker to uncover all potential discounts you may qualify for, including multi-vehicle savings, incentives for completing driver safety courses, and benefits for good students or retirees. These savings can significantly reduce your overall premiums.

Consider Alternative Transportation Options

Minimizing your car's time on the road can lower your risk exposure. Whenever possible, opt for public transit, carpooling, or biking to keep your mileage down and potentially save on your insurance.

The Latest

Check out our latest blog posts on all things auto insurance…