Ready to start?

Kitchener drivers can save an average of $300 on insurance with BIG.

The Best Car Insurance in Kitchener

Kitchener is a thriving city in the heart of the Waterloo Region, known for its blend of urban development and charming historical roots. With bustling streets, busy commuters, and growing neighbourhoods, Kitchener is a hub for tech innovation, education, and cultural events. Thousands of drivers navigate its roads daily, whether they're heading to Victoria Park, attending an event at the Kitchener Memorial Auditorium, or commuting via the Conestoga Parkway.

With Billyard Insurance Group (BIG), securing affordable and customized auto insurance quotes has never been easier. No matter your situation, a BIG broker will work with you to find a policy that suits your unique needs, giving you confidence every time you drive in Kitchener.

Join the Hundreds of Thousands Who Have Trusted BIG

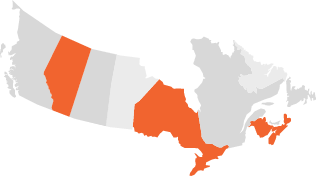

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Kitchener.

Access to a Large Array of Trusted Insurance Providers

How to Purchase Personalized Car Insurance in Kitchener

Follow these simple steps to get a tailored car insurance quote:

Enter Your Personal Information

Provide essential details like your postal code, vehicle type, driving history, and insurance background. This information will help us find the most suitable insurance options for you.

Personalize Your Coverage

A BIG car insurance broker in Kitchener will contact you to review your quotes, discuss your coverage preferences, and customize your policy by exploring deductible options, limits, and any additional protection you may need.

Secure Your Auto Insurance Policy

Once you’re happy with the details, sign your digital application to finalize your policy. You’ll then be ready to hit the road in Kitchener with peace of mind.

Find a Kitchener Insurance Brokerage Near You

Kitchener

201-500 Fairway Rd S.

Kitchener, ON N2C 1X3

Kitchener Auto Insurance FAQs

Auto insurance costs in Kitchener vary depending on several factors specific to you, such as:

- Your age, gender, marital status, and address

- How long you've been licenced and insured

- Any recent tickets, claims, or insurance cancellations

- Details about your vehicle, including its make, model, and year

- How often and how far you drive

Yes, it is illegal to drive without valid car insurance in Kitchener. All drivers must carry at least the minimum amount of insurance required by Ontario law. Having the proper coverage protects you financially in case of an accident, helping to cover medical bills, repair costs, and legal fees.

While Kitchener doesn’t have the highest insurance rates in Ontario, prices can vary from person to person. Your individual premium will depend on personal circumstances, but maintaining a clean driving record and comparing quotes can help lower your costs.

For a quick and easy way to compare auto insurance quotes in Kitchener, visit thebig.ca. You’ll be able to request a quote for car insurance in Kitchener from various providers and find the best options suited to your needs.

Yes, you can still request an auto insurance quote for Kitchener even if you haven't purchased a vehicle. By providing details on the make and model of cars you are considering, you can get a sense of the insurance costs and plan accordingly before finalizing your purchase.

When requesting an online insurance quote for Kitchener, you will need to provide the following:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of licence

- Licence dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, licence suspensions

- Any insurance cancellations

- Your contact information so one of our Kitchener car insurance brokers can reach you

If you live in Kitchener and are looking to save on car insurance, there are several strategies you can use to reduce your premiums. However, keep in mind that while lowering your insurance costs can help your budget, it's essential to ensure you're not sacrificing necessary coverage. The goal is to find a balance between affordability and protection. BIG’s vast network of insurance partners allows you to compare rates and potentially save hundreds.

Here are some effective ways to lower your auto insurance in Kitchener:

- Work with an insurance broker for personalized advice

- Bundle your home and auto insurance policies

- Install winter tires to qualify for discounts

- Maintain a safe driving record

- Reduce your annual mileage

- Ask about any available discounts

Getting auto insurance in Kitchener is a straightforward process. You can request and compare quotes online in just a few minutes. Once you’ve chosen a policy, we’ll guide you through the paperwork, and your coverage can start shortly after signing, ensuring you're ready to hit the road without delay!

What Determines the Cost of Car Insurance in Kitchener?

Auto insurance rates in Kitchener are determined by a range of factors that assess your overall risk as a driver. Understanding what influences these rates can help you make informed decisions and potentially save money. When getting a quote, it's crucial to provide accurate and honest information to ensure you're adequately covered without surprises later

Where you live in Kitchener impacts your insurance costs. Insurance providers consider the crime rate, theft incidents, and accident statistics in your neighbourhood. Areas with higher risks may result in higher premiums.

Your age, gender, and marital status play a significant role in determining your auto insurance rate. Younger drivers, particularly those under 25, typically face higher premiums due to their inexperience. Statistically, male drivers may pay more because they are seen as higher-risk, often engaging in riskier driving behaviours. On the other hand, married individuals may enjoy lower rates, as they are perceived to be more responsible

A clean driving record is a major factor in securing lower insurance rates. If you avoid traffic violations and accidents, insurers view you as a lower-risk driver. On the flip side, any record of speeding tickets, accidents, or other violations will likely increase your premium.

If you have a history of filing insurance claims, especially those where you were at fault, this can increase your premiums. Insurers see frequent claims as a sign that you're more likely to make future claims, thus raising your risk level. However, claims where you were not at fault typically have less impact on your rates.

The car you drive matters. Insurance companies consider the make, model, and age of your vehicle when calculating rates. Newer cars with advanced safety features may qualify for lower premiums, while luxury or high-performance cars often come with higher insurance costs due to more expensive repairs and a greater risk of theft.

The more frequently you drive, the higher your insurance premiums could be. If your vehicle is used for long commutes or business purposes, this increases your risk of an accident. Conversely, if you drive less or only use your car occasionally, you could benefit from lower rates.

In Ontario, certain coverages like Liability, Uninsured Motorist, and Accident Benefits are mandatory. However, you can customize your policy by adding optional coverages such as Collision or Comprehensive coverage. While more coverage may increase your premium, it also provides greater protection, which can be worth the investment in the event of an accident. Consulting a BIG broker can help you find the right balance between sufficient coverage and affordability.

Tips for Saving on Auto Insurance in Kitchener

Finding affordable car insurance quotes in Kitchener is easier than you might think. Here are some tips to help you lower your rates while ensuring you have the right coverage.

Work With a Car Insurance Broker in Kitchener

A BIG broker can compare car insurance quotes for Kitchener from multiple providers and find the most competitive rates for you. With access to a wide range of insurers, brokers offer personalized service that aligns with your specific needs and budget, saving you time and money.

Bundle Your Insurance Policies

One of the simplest ways to save is by bundling your auto insurance with other types of coverage, such as home or tenant insurance. Many insurers offer significant discounts when you have multiple policies with them, which could lead to substantial savings.

Install Winter Tires

Kitchener’s snowy winters make winter tires a necessity, and many insurers reward drivers who install them with discounts. Winter tires reduce the risk of accidents on icy roads, helping you stay safe while also lowering your premiums.

Maintain a Good Driving Record

Safe driving is one of the most effective ways to lower your insurance rates. Avoiding accidents, speeding tickets, and other traffic violations will help you qualify for reduced premiums. The longer you go without claims, the better your rates will be.

Take Advantage of Discounts

Many insurers offer various discounts, such as savings for completing a defensive driving course, having an anti-theft system in your vehicle, or being a member of certain professional organizations. A BIG broker in Kitchener can help you find and apply for these discounts.

Reduce Your Mileage

If you drive less, you reduce your risk of accidents, which can lower your insurance rates. Consider carpooling, using public transportation, or working from home to reduce your annual mileage and qualify for low-mileage discounts.

The Latest

Check out our latest blog posts on all things auto insurance…