Ready to start?

Mississauga drivers can save an average of $300 on insurance with BIG.

The Importance of Choosing the Right Car Insurance in Mississauga

Mississauga is a vibrant and diverse city known for its artistic community, historic villages, multicultural influences, and recreational activities. It is the only city in the Greater Toronto Area that is serviced by seven major highways and is home to Canada’s busiest airport, Toronto Pearson International Airport, making it a hub for connectivity.

With such a high volume of traffic moving through the area, purchasing sufficient auto insurance in Mississauga should be a priority for everyone. That way, you can drive with peace of mind as you head out for a day of shopping at Square One or make your way to Port Credit for a bite to eat with family. No matter where the road takes you in Mississauga, a BIG broker can tailor a car insurance policy that meets all your needs.

Join the Hundreds of Thousands Who Have Trusted BIG

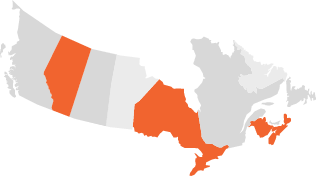

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Mississauga.

Access to a Large Array of Trusted Insurance Partners

How to Request a Quote for Car Insurance in Mississauga

Follow these three easy steps to receive auto insurance quotes in Mississauga:

Share Your Details

Provide us with essential information about yourself, your vehicle's make and model, and your driving history. This allows us to create a list of the best car insurance quotes specifically for Mississauga.

Tailor Your Coverage

After receiving your quotes, a representative from BIG will contact you to help you determine the most suitable option for your needs. They will also work with you to set appropriate deductibles, limits, and coverage for your policy.

Confirm Your Insurance

Once you've reviewed and are content with your policy's inclusions, a digital application will be sent your way. Simply sign the document, and with a quick click, you can secure your insurance coverage hassle-free.

Find a Mississauga Insurance Brokerage Near You

Erin Mills

2520 Eglinton Ave W, Unit 222

Mississauga, ON L5M 0Y4

Mississauga East

106-1055 Canadian Place

Mississauga, ON L4W 0C2

Mississauga West

208-320 Matheson Blvd W

Mississauga, ON L5R 0H2

Port Credit

39 Lakeshore Road E, Unit B100

Mississauga, ON L5G 1C9

Common Questions About Car Insurance in Mississauga

The cost of insurance is different for everyone. Car insurance quotes in Mississauga are based on details related to you as well as your vehicle, including:

- How old you are

- Your gender

- Whether you are single or married

- Where you live

- Your history as a licenced and insured driver (years as a licensed driver, tickets or suspensions, previous claims, or insurance cancellations)

- The year, make, and model of your car

- How often your car is driven each year

Provincial laws require all drivers living in Ontario to have the minimum required coverage. This means that, at the very least, anyone in Mississauga must possess insurance that has $200,000 in Third Party Liability, Accident Benefits, and Uninsured Automobile coverage. That said, it is highly recommended that you carry more insurance than this.

On average, drivers in Mississauga experience some of the highest insurance premiums in Ontario. This can be attributed to the city’s higher traffic density, risk of accidents, frequency of insurance claims, and crime rates.

Simply request a quote online from BIG, and in just a few moments, you’ll receive information about the best rates available. If you need assistance in choosing the right policy, contact a BIG broker!

Absolutely! You are highly encouraged to research insurance prices before buying any vehicle. This way, you can ensure that all of the additional costs that come with the car you are interested in fall within your budget.

Before you request an auto insurance quote for Mississauga, be sure to have the following information:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of license

- License dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, license suspensions

- Any insurance cancellations

- Your contact information so one of our car insurance brokers in Mississauga can reach you

Finding an affordable insurance policy is not as hard as it sounds. It’s important to remember that paying less for insurance can lead to less coverage. If price is a major concern for you, the following methods can help lower your premiums without compromising your protection:

- Seeking guidance from a broker

- Bundling multiple policies, such as your home and auto insurance

- Using winter tires

- Being a safe driver and following the rules of the road

- Reducing the amount you drive, if possible

- Asking your provider if you’re eligible for any discounts

Once you’ve reviewed your options and selected a policy, we will take care of the paperwork so that you can officially sign and drive the streets of Mississauga worry-free.

What is Factored in When Determining the Price of Auto Insurance in Mississauga?

Finding the best car insurance in Mississauga is an intricate process that encompasses many factors. Before setting your premium, providers will want to determine how much of a risk you are to insure and the likelihood of you filing a claim. When requesting a quote through BIG, it’s always best to be open and honest to ensure there aren’t any gaps in your coverage or issues when you file a claim.

The neighbourhood you call home plays a pivotal role in shaping your auto insurance rates. Insurance providers assess the local risk landscape, factoring in variables like crime rates, theft incidents, and vandalism prevalence. If your residence falls within an area prone to higher levels of these risks, you're likely to face elevated premiums. Conversely, living in a safer neighbourhood with lower occurrences of such incidents can contribute to more favourable and cost-effective auto insurance rates.

Demographic factors like age, gender, and marital status significantly influence your insurance rates. Younger drivers, especially teenagers, often face higher premiums due to their perceived higher risk. Gender can also play a role, as some insurers historically considered males riskier drivers, though this is changing in some regions. Additionally, marital status can impact rates, with married individuals often enjoying lower premiums as they are statistically seen as more responsible and less prone to accidents.

Your driving record directly impacts your insurance rates, with a clean record generally resulting in lower premiums. If you have a history of traffic violations, insurers may view you as a higher risk, leading to increased insurance costs.

Insurance providers assess your past claims to gauge the level of risk you present as a policyholder. A history of frequent or costly claims may result in higher premiums, as it suggests a greater likelihood of future claims, while having minimal or no claims can lead to lower rates.

Newer cars often have higher replacement costs, leading to higher premiums. Additionally, high-performance or luxury models may come with increased insurance costs due to their higher repair expenses and increased risk of theft or damage. Conversely, insurance rates for older and less expensive models tend to be much more affordable.

Vehicle usage is a key factor in determining auto insurance rates. The more you use your car, especially for commuting long distances or frequent travel, the higher the risk exposure, potentially resulting in increased premiums. On the other hand, if you only use your car occasionally, such as driving for pleasure or maintaining a low annual mileage, your insurance rates should reflect this.

Opting for comprehensive coverage, which includes protection against various risks like theft, vandalism, and natural disasters, tends to increase premiums. On the other hand, choosing to go with only the minimum amount of coverage might result in lower rates, but it provides less extensive protection. Additionally, selecting higher coverage limits and adding optional coverage options, such as collision coverage, can also lead to higher insurance costs.

What Are the Best Ways to Save on Car Insurance in Mississauga?

In a dynamic city like Mississauga, finding ways to save on your auto insurance is a must. Many tips and tricks can help you get affordable car insurance quotes in Mississauga. Check them out below, and never overpay for insurance again!

Contact a Car Insurance Broker in Mississauga

By consulting with a BIG broker, you gain access to personalized advice and a tailored understanding of the best coverage options, ensuring your car insurance aligns seamlessly with your unique needs.

Look Into Bundling Multiple Policies.

Bundling your home and auto insurance often results in savings, making it a cost-effective choice. Additionally, having both policies with the same company streamlines administrative tasks, conveniently providing you with a single point of contact for any inquiries or claims.

Purchase Winter Tires

Winter tires are designed with a special tread compound and tread pattern to provide better traction on snow and ice. Insurance providers reward these tires for their enhanced safety, which can result in lower premiums.

Be a Responsible Driver

Practicing safe driving habits is a key strategy for saving on car insurance, as it demonstrates to insurers that you pose a lower risk. By maintaining a clean driving record with no accidents or traffic violations, you may qualify for discounts and lower premiums.

Explore Available Discounts

By leveraging the expertise of a BIG broker, you can maximize potential savings and ensure that you're taking advantage of all eligible discounts, ultimately optimizing your insurance coverage at a more cost-effective rate.

Lower Your Annual Mileage

Insurance companies often consider mileage a factor in determining risk. If you drive fewer miles, you're less likely to encounter potential hazards on the road. If possible, try using public transportation, biking, walking, or carpooling to keep your mileage down.

The Latest

Check out our latest blog posts on all things auto insurance…