Ready to start?

Ottawa drivers can save an average of $300 on insurance with BIG.

Receive Affordable Car Insurance Quotes for Ottawa

Ottawa offers drivers a mix of urban and suburban experiences characterized by well-maintained roads and scenic routes. Highway 417 connects various parts of the region, roundabouts contribute to efficient traffic flow, and a comprehensive grid system makes navigating the nation’s capital by car easy.

That said, rush hour traffic during daily commutes, heavy snowfalls during the cold winter months, and tourists visiting Capital Hill and ByWard Market in the summertime create potential challenges that motorists must approach with caution. No matter where you live in the city, ensuring that you have sufficient car insurance in Ottawa is vital to enjoying all it has to offer. If you’re unsure whether your current policy meets all of your needs or are simply looking for a new policy, a BIG car insurance broker in Ottawa can help.

Join the Hundreds of Thousands Who Have Trusted BIG

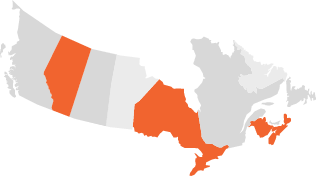

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Ottawa.

Access to a Large Array of Trusted Insurance Providers

How to Get Personalized Car Insurance from BIG

Get a car insurance quote made just for you by completing the following steps:

Tell Us a Bit About You

Before we can process your quote, we’ll need to know where you live, what kind of car you drive, and details about your driving record. After submitting that information, we’ll provide you with quotes for the best insurance in Ottawa.

Tailor Your Protection to Your Needs

Once you’ve received your quotes, a BIG car insurance broker in Ottawa will reach out to discuss additional coverage options and different ways you can customize your insurance to meet your specific requirements.

Secure Your Insurance

Review and sign your digital insurance application to lock in your personalized insurance policy. You can now drive worry-free in Ottawa, knowing you have the best coverage available.

Find an Ottawa Insurance Brokerage Near You

Alta Vista

1376 Bank Street, Suite 210

Ottawa, ON K1H 7Y3

Kanata

260 Hearst Way, Suite 601

Kanata, ON K2L 3H1

Westboro

311 Richmond Road, Suite 300

Ottawa, ON K1Z 5H8

FAQs About Car Insurance in Ottawa

Your auto insurance price is unique to you and based on several details, such as:

- The type of car you drive

- How many kilometres you drive on average per year

- Your address, marital status, age, and gender

- How long you’ve had your license and been insured

- If you have recently received a ticket for a traffic violation or had your license suspended

- Previous insurance claims and if you’ve ever had insurance cancelled

Driving without car insurance in Ottawa is illegal and can result in serious consequences. If caught, you may face fines, license suspension, and legal penalties. Moreover, operating a vehicle without insurance exposes you to financial risk, as you'll be personally responsible for covering any damages or injuries resulting from an accident. It's crucial to have valid car insurance to comply with regulations and safeguard yourself against financial and legal repercussions.

Despite being the capital city of Canada and one of the country's largest cities, the price of car insurance in Ottawa is rather favourable when compared to other cities in Ontario. Keep in mind that the exact price you pay will depend on numerous factors and can change over time.

The best place to review car insurance rates is thebig.ca. After requesting a quote, you’ll be presented with the best quotes from BIG’s network of insurance providers and can select a plan that you are comfortable with.

Yes, it's advisable to request a quote for auto insurance before buying a car. Knowing the potential insurance costs associated with a specific vehicle can help you make an informed decision about your purchase. By obtaining a quote in advance, you can factor in insurance costs and ensure they align with your budget before committing to a car purchase.

Here is what you will need to get a quote for car insurance in Burlington:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of license

- License dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, license suspensions

- Any insurance cancellations

- Your contact information so our Burlington car insurance brokers can reach you

Exploring different methods that save on insurance is a wise approach many people pursue to manage their finances. Just keep in mind that paying less on your premium doesn’t always benefit you in the long run, especially if you find yourself in a situation where your coverage doesn’t cover all the expenses you incur following a collision. Here are some useful tips you can follow to lower the cost of your insurance without compromising protection:

- Consult an insurance broker

- Bundle your property and car policies

- Equip your car with winter tires

- Avoid tickets for traffic violations

- Limit your d

Securing auto insurance in Ottawa is a relatively seamless process. After you have selected your desired policy, we will prepare your official insurance documents. Simply sign the paperwork and your coverage will kick in shortly.

Factors that Influence Car Insurance in Ottawa

Car insurance prices are influenced by various factors, each contributing to the unique premium assigned to an individual or vehicle. Insurers consider a range of elements, taking into account demographics, driving history, and vehicle-related details. The combination of these factors results in personalized insurance rates, reflecting the diverse aspects that insurers evaluate to determine coverage costs.

Location plays a crucial role in determining car insurance rates. Areas with higher population density or increased instances of traffic accidents may experience higher premiums. Additionally, the prevalence of vehicle theft or vandalism in a specific neighbourhood can impact insurance costs.

These demographics can significantly influence your insurance. Younger drivers, especially those under 25, often face higher premiums due to the perception of greater risk. Additionally, statistics indicate that male drivers may face higher rates than their female counterparts. Marital status can also impact rates, as married individuals may be seen as more responsible and less prone to risky driving behaviours.

A clean record with no accidents or traffic violations is likely to result in lower insurance costs, as it reflects a lower perceived risk. On the other hand, a history of accidents or traffic tickets can lead to increased premiums.

Insurance companies assess your claims history to gauge the likelihood of future claims. Individuals with a history of filing numerous claims may be considered higher risk, leading to elevated premiums. Conversely, those with a minimal claims history and a track record of responsible driving may qualify for lower rates, reflecting a lower risk profile.

The age, make, and model of your vehicle significantly influence insurance rates. Generally, newer cars with advanced safety features may qualify for lower premiums due to reduced risk. However, high-performance or luxury vehicles often incur higher insurance costs, as they may require more expensive repairs and are perceived as more susceptible to theft or vandalism.

This is pivotal when calculating insurance premiums. The frequency and purpose of usage, whether for daily commuting, business, or personal reasons, directly impact the assessed risk by insurers. Additionally, having multiple people insured on the same vehicle can influence rates, with the number of drivers and their driving records contributing to the overall insurance premium.

Typically, selecting a policy with increased collision, comprehensive, and increased liability coverage results in higher premiums. Conversely, choosing a more basic coverage may lead to lower rates, but it's essential to strike a balance between adequate protection and affordable premiums based on individual needs and risk tolerance.

Get the Best Car Insurance in Ottawa for Less!

If you’re in search of the best coverage at the lowest prices in Ottawa, then look no further. You can secure a policy that fits your budget and provides adequate protection by following these six easy tips:

Reach Out to a BIG Broker

An experienced BIG broker in Ottawa will leverage their auto insurance expertise to find the perfect policy for you. They will take the time to understand your situation so that there are no lapses in coverage and that you never overpay for insurance again.

Consider Bundling Policies

Bundling home and auto insurance offers several benefits, primarily cost savings and convenience. Insurers often provide discounts to policyholders who combine both coverages, reducing premiums by as much as 20%.

Invest in Winter Tires

With the prevalence of snow and freezing temperatures in Ottawa, winter tires provide an essential layer of safety and performance. Insurance companies incentivize drivers to take this proactive measure and will provide discounts on policies during the winter months.

Follow the Rules of the Road

Motorists who maintain a clean driving record are rewarded for their efforts. This often comes in the form of lower insurance premiums, reflecting the reduced risk faced by providers when insuring a driver who exhibits safe driving behaviours.

Explore Discounts

Are you a long-term policyholder, a student with good grades, or a member of an organization or alumni association? You might be entitled to additional discounts. These are just a few examples of some easy ways you can save, so don’t hesitate to ask a broker if there are any other opportunities you can take advantage of!

Drive Your Car Less

Driving less results in a lower chance of being involved in a collision. This translates to a reduced risk profile for the driver and, consequently, lower insurance premiums. Alternative modes of transportation such as cycling, public transit, and walking are recommended, if possible.

The Latest

Check out our latest blog posts on all things auto insurance…