Ready to start?

Waterloo drivers can save an average of $300 on insurance with BIG.

Drive Confidently in Waterloo

Waterloo, known for its tech innovation hub, and lively uptown core, offers a dynamic driving experience. Whether you’re navigating the streets around the University of Waterloo, commuting along King Street, or enjoying the scenic Waterloo Park, having reliable car insurance is crucial to keeping you covered on the road. At Billyard Insurance Group (BIG), we provide tailored auto insurance policies that cater to the unique needs of Waterloo drivers. Get a personalized online insurance quote for Waterloo today and a BIG broker will help you find the best coverage at competitive rates!

Join the Hundreds of Thousands Who Have Trusted BIG

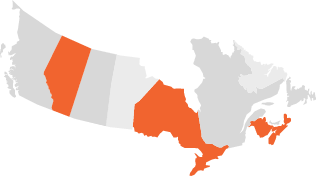

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Waterloo.

Access to a Large Array of Trusted Insurance Providers

How to Get Personalized Car Insurance in Waterloo

Follow these steps to secure a custom auto insurance quote for Waterloo:

Provide Your Details

Start by sharing your postal code, vehicle type, and driving history. This data will help us find quotes for the best car insurance in Waterloo.

Customize Your Coverage

Once your quotes are ready, a BIG car insurance broker in Waterloo will connect with you to review your policy. They will guide you through selecting the right coverage limits, deductibles, and any additional options tailored to your needs.

Finalize Your Insurance Application

When you’re satisfied with your coverage, sign your digital application and you’ll soon be ready to drive around Waterloo with your new policy.

Find a Waterloo Insurance Brokerage Near You

Waterloo

235 Bathurst Drive, Second Floor

Waterloo, ON N2V 2E4

Common Questions About Waterloo Car Insurance

The cost of auto insurance in Waterloo depends on various personal factors, such as:

- Your age, gender, and marital status

- The make, model, and year of your vehicle

- Your driving history, including tickets and claims

- How often you drive

- Your home address

Yes, Ontario law requires you to have a valid insurance policy. Driving without it can lead to serious consequences, including hefty fines, impoundment of your vehicle, and even a suspension of your licence. Without insurance, you would also be responsible for covering the costs of any damages or injuries caused in an accident.

Waterloo’s insurance rates are moderate compared to some other cities in Ontario. Your personal rate will depend on factors like your driving record and the type of vehicle you drive. Staying accident-free and shopping around for quotes can help keep your premiums lower.

You can save on car insurance in Waterloo by:

- Comparing quotes from multiple providers

- Bundling your home and auto insurance policies

- Installing winter tires to qualify for discounts

- Keeping a clean driving record

- Reducing your annual mileage

Yes, you can request an auto insurance quote before purchasing your vehicle. Provide details of the vehicles you are considering, like the make and model, and you’ll be able to estimate your future insurance costs.

Here is what is required to get a quote for car insurance in Waterloo:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of licence

- Licence dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, licence suspensions

- Any insurance cancellations

- Your contact information so our Waterloo car insurance brokers can reach you

Once you've selected your policy, your insurance can usually be activated within a short time frame. Many insurers offer quick processing, ensuring you're covered promptly.

The quickest way to compare car insurance quotes in Waterloo is by completing BIG's online quote form. By entering your details, you’ll receive multiple quotes from different providers, allowing you to find the best coverage at the most competitive rate.

What Factors Determine the Cost of Auto Insurance in Waterloo?

Auto insurance premiums in Waterloo are influenced by a variety of factors that insurers use to evaluate the level of risk you present as a driver. By understanding the key elements that contribute to these costs, you can take steps to secure the best possible rate. When working with a BIG broker, it's important to provide accurate information to ensure your coverage meets your needs and avoids any issues in the event of a claim.

Where you live in Waterloo can greatly affect your insurance rates. If you reside in an area with high traffic congestion, theft, or vandalism rates, you may see higher premiums. However, living in quieter, low-risk neighbourhoods typically results in more affordable car insurance quotes.

Your age, gender, and marital status are key factors that impact your insurance premiums. Young drivers, especially those under 25, often face higher rates due to a lack of driving experience. Male drivers might also see increased costs due to their higher statistical risk. Married individuals may benefit from lower premiums, as they are often viewed as more responsible drivers.

One of the best ways to secure lower insurance rates is to maintain a clean driving record. Drivers with no history of accidents or traffic violations are seen as low-risk, which can result in more favorable premiums. If you have multiple infractions or accidents on your record, insurers are likely to charge more due to the increased risk.

If you've filed numerous or costly insurance claims in the past, it can impact your current premiums. A history of frequent claims suggests a higher likelihood of future incidents, resulting in higher rates. Conversely, a claims-free record can help reduce your premium and position you as a low-risk policyholder.

The make, model, and age of your vehicle play a significant role in determining your insurance rates. Newer, high-performance vehicles typically come with higher premiums due to their increased risk of theft or costly repairs. On the other hand, cars with strong safety ratings or lower repair costs may help keep premiums down.

The frequency of your vehicle use is another important factor. Drivers with long daily commutes or those who frequently use their vehicle for business may face higher premiums, as the increased time on the road raises the chance of accidents. If you drive less frequently, you could qualify for lower rates.

The level of coverage you select will also affect your premiums. Opting for comprehensive coverage that includes protection against theft, vandalism, and natural disasters will increase your insurance costs. However, choosing basic coverage may reduce your premiums but offer less protection overall. Working with a BIG broker can help you find the right balance between coverage and affordability to suit your needs.

Tips to Help You Save on Waterloo Vehicle Insurance

As you navigate the vibrant streets of Waterloo—whether you're heading to the University of Waterloo or enjoying a leisurely day at RIM Park—having the right car insurance is crucial. Here are some effective tips to help you save on your premiums while ensuring you stay protected on the road.

Connect With a Waterloo Car Insurance Broker

A BIG broker in Waterloo is your go-to expert for personalized advice on auto insurance. They'll help you find the best coverage tailored to your needs while accessing competitive rates from various insurance providers, ensuring you never overpay or have coverage gaps.

Bundle Multiple Policies

Combining your car insurance with home or tenant insurance can lead to significant savings. With a bundled policy, you benefit from convenience, a single point of contact for claims, and often a discount that lowers your overall premium.

Invest in Winter Tires

Installing winter tires not only enhances your vehicle's safety but may also earn you a discount on your insurance. This proactive step helps reduce your risk of accidents during icy conditions.

Practice Safe Driving

Safe driving habits are essential for keeping your premiums low. A clean driving record demonstrates to insurers that you are a low-risk driver, which can lead to discounts and more favourable rates.

Explore Available Discounts

Your BIG broker can help identify all the discounts you qualify for, such as multi-vehicle savings, incentives for completing driver safety courses, and discounts for students or retirees. Taking advantage of these opportunities can lead to significant savings on your premiums.

Consider Alternative Transportation Options

Reducing the amount of time your car spends on the road can help lower your risk exposure. Whenever possible, opt for public transit, biking, or carpooling. Not only does this reduce your mileage, but it can also help you qualify for discounts on your insurance.

The Latest

Check out our latest blog posts on all things auto insurance…