Ready to start?

Welland drivers can save an average of $300 on insurance with BIG.

Driving in Welland

The Rose City offers a pleasant and convenient driving experience with its well-connected network of roads and highways. Niagara Street runs through the heart of Welland, providing easy access to local shops, businesses, and restaurants. East Main Street is another crucial route, connecting the city to nearby towns and facilitating smooth traffic flow.

When it comes to driving in Welland, ensuring you have reliable car insurance is a priority. Fortunately, the area is home to Billyard Insurance Group (BIG), one of Canada’s leading insurance brokerages. With a wide range of auto insurance solutions available, A BIG broker can help you choose a policy that caters to your specific needs.

Join the Hundreds of Thousands Who Have Trusted BIG

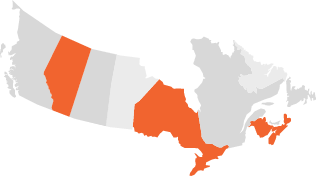

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Welland.

Access to a Large Array of Trusted Insurance Partners

Custom Car Insurance Quotes for Welland

Follow these quick and easy steps to start saving on insurance:

Enter Your Information

Tell us about the car you’d like to insure and provide us with details like your postal code and your driving record. Once submitted, we’ll take these details and find the best car insurance for Welland.

Build a Personalized Policy

A BIG broker will reach out shortly after to discuss your options and key details such as deductibles, limits and exclusions, and additional coverage options that you should consider.

Finalize Your Coverage

Once you've confirmed your policy’s inclusions, you can sign your digital insurance application. With just one simple click, you’ll be covered and ready to hit the road.

Find a Welland Insurance Brokerage Near You

Welland

38 East Main St,

Welland, ON L2B 3W3

Welland Car Insurance FAQs

Insurance rates vary from person to person and are calculated using various details, such as:

- The year, make, and model of your vehicle

- Your estimated annual mileage

- Your marital status, gender, age, address, and driving experience

- Your driving record and insurance history

No, you are not permitted to drive anywhere in Canada without auto insurance. This is a serious legal offence and can lead to devastating consequences. This includes facing substantial fines, having your license suspended, and having your car impounded. Additionally, you would be at risk of having to pay for any legal fees, medical bills, and repair costs that come as a result of being in a collision with another car.

Auto insurance in Welland is pretty affordable. This is especially true when compared to larger cities with higher population densities and traffic volume. That said, the price of insurance is different for everyone, so no two policies are the same.

To review online insurance quotes for Welland, simply visit thebig.ca. Enter your information into the questionnaire, and you’ll be presented with the best rates available.

Believe it or not, you don’t need to have a car to request a quote for car insurance. Most people want to know how much it will cost to insure a vehicle before they buy it. This allows you to determine whether a car you are interested in actually fits your budget. If the price is right, that’s great! Just make sure your policy is in force before taking your new car out for the first time.

You will need to provide the following details when requesting a quote for car insurance:

- Your postal code

- Vehicle information:

- Year, make, and model

- If you have winter tires

- If it’s leased, financed, or owned

- Commute distance and annual kilometres

- The coverage you want

- Driver information:

- Your name, gender, marital status, and birthdate

- Class of license

- License dates for your G1, G2, and G (be as accurate as possible)

- Number of years insured

- Number of years with your current insurance company

- Any claims, tickets, license suspensions

- Any insurance cancellations

- Your contact information so our Burlington car insurance brokers can reach you

There are many steps you can take to get affordable car insurance quotes. It’s important to note, that lower premiums can also mean less coverage. The following opportunities can contribute to lower premiums and increased savings on car insurance without sacrificing the protection you need:

- Lower your risk of a collision and use snow tires during winter months

- Work on your driving habits (i.e. practice safe driving or drive less)

- Pay for your policy annually instead of monthly

- Ask if you qualify for any discounts

Obtaining insurance is a straightforward process. Once you’ve picked a policy, our team will prep documents for you to sign, and you’ll be good to go shortly after.

What Influences the Cost of Car Insurance in Welland

Insurance providers calculate car insurance premiums by assessing the overall risk a driver poses. Rates can be influenced by various factors, including the driver's age, driving history, type of coverage, and vehicle, to name a few. This results in varying costs for different individuals.

The neighbourhood you reside in plays a pivotal role in shaping your insurance rates. If you find yourself in an area prone to theft, vandalism, and traffic, your premiums are likely to increase. The risk of your vehicle being stolen or damaged in such locations could trigger significant claim payouts from your insurance provider, influencing the overall cost of your coverage. On the flip side, opting for a safe, quieter area decreases the likelihood of encountering such incidents and will lower your insurance rates.

Your insurance rates are notably shaped by demographic factors such as age, gender, and marital status. Younger drivers, particularly those under 25, often deal with elevated premiums due to the perceived higher risk associated with their age group. While historical trends have linked higher rates to male drivers, the landscape is evolving in some regions. Moreover, marital status can also sway rates, with married individuals generally enjoying lower premiums. The assumption here is that marital status indicates a higher level of responsibility and a lower likelihood of engaging in risky driving behaviours.

The longer you maintain a clean driving record, free of accidents and traffic violations, the better your chances of paying lower insurance premiums. Conversely, a history marked by accidents or traffic infractions may label you as a higher-risk driver, leading to heightened insurance costs.

Insurance companies assess claims history to gauge risk, with frequent claims leading to higher premiums. At-fault accidents typically increase rates, while not-at-fault incidents have less to minimal impact. A history of multiple claims may result in a higher deductible, influencing overall insurance costs.

The year, make, and model of your vehicle are considered to determine the likelihood of it being stolen and the cost to repair or replace the car in the event of a claim. For example, a newer car may benefit from advanced safety features. However, it may also come with a higher risk of theft and more expensive parts. In this example, it likely costs more to insure.

The frequency and purpose of vehicle usage significantly impact insurance premiums. High annual mileage or a long commute may increase the likelihood of claims, affecting rates. That said, if you have access to private parking arrangements, you could potentially save. Insurers also consider the number of drivers and their driving records when assessing auto insurance rates.

Choosing coverage is a balancing act between adequate protection and affordable premiums. Mandatory coverage includes Liability, Uninsured Motorist, and Accident Benefits, but consulting a BIG broker opens up a variety of customization options. From adjusting deductibles to adding features like rental car coverage or accident forgiveness, drivers can tailor their policies based on individual needs and circumstances.

Start Saving on Car Insurance in Welland

Whether you are heading out to run errands at the Seaway Mall or making your way to Merritt Island for some family fun, you can drive with peace of mind when you have coverage that is designed specifically for you. As a bonus, we’ve provided some tips you can follow to save on insurance and enjoy an even better driving experience.

Reach Out to One of Our Welland Brokers

Experience the expertise of a broker who will ensure there are no gaps in your coverage lapses and no overpayments on your premiums. BIG brokers can unlock incredible savings through multiple insurance companies and present you with the most competitive options.

Bundle Your Insurance Policies

Combine your car and property policies to enjoy significant savings! The convenience of having both policies with the same company offers a single point of contact for inquiries or claims, adding further practicality to this bundled approach.

Buy Winter Tires

Install winter tires on your car to enjoy enhanced safety during the snowy season. This proactive measure will reduce your risk of being in an accident and earn you a discount on your policy.

Obey the Rules of the Road

Enjoy lower insurance premiums by maintaining a clean driving record. Doing so showcases safe driving behaviours to your insurance provider and often leads to you being rewarded with a lower insurance premium.

Look for Discounts

Combine policies for a multi-vehicle discount, enjoy savings from completing driver training, and explore potential discounts for retirees, good students, experienced drivers, and electric car owners. Be sure to ask your BIG broker if any of these opportunities to save are available to you!

Consider Other Modes of Transportation

The less your car is on the road, the less likely you will be in an accident. While you may still require your vehicle at times, carpooling, walking, and using public transit, when possible, will lower your annual mileage and can help you save.

The Latest

Check out our latest blog posts on all things auto insurance…