Ready to start?

Finding car insurance in

New Brunswick made simple.

Driving in New Brunswick offers a mix of coastal beauty and forested landscapes. From the rugged Fundy coastline to the scenic drives through the Appalachian Mountains, this province is full of breathtaking views and diverse terrains that make every journey an adventure. Whether you’re navigating quaint city streets, exploring the picturesque routes along the Saint John River, or heading to the Bay of Fundy to witness the towering Hopewell Rocks, having dependable car insurance in New Brunswick is essential.

If building the perfect auto insurance policy for your situation feels a bit daunting, a BIG broker can help simplify the process. Our brokers will find the best coverage at a price that fits your budget. That way, you can hit the road with confidence, knowing you’re protected no matter where the roads in New Brunswick take you.

Join the Hundreds of Thousands Who Have Trusted BIG

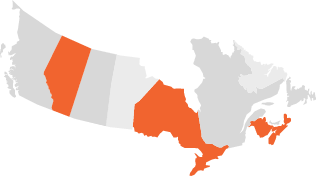

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Ontario

- New Brunswick

- Nova Scotia

Professional Service

Our team of experienced brokers in New Brunswick will provide outstanding customer service and are dedicated to helping you find personalized coverage.

Access to a Large Array of Trusted Insurance Partners

How Does Auto Insurance Work in New Brunswick?

In New Brunswick, there are both mandatory and optional forms of coverage that drivers can include in their policy. Here is a breakdown to help you make an informed decision.

Mandatory Coverages

The following forms of coverage must be included in all New Brunswick car insurance policies:

Third Party Liability

As a critical component of automobile insurance in New Brunswick, this offers protection if you are responsible for injuring someone or damaging their property while driving. In New Brunswick, the minimum required liability coverage is $200,000.

Accident Benefits

This provides you and your passengers with financial support for medical expenses, rehabilitation, and income replacement if you are injured in an accident. It ensures that you have access to the care and resources needed to recover.

Uninsured Automobile Insurance

This provides coverages for injuries or vehicle damage if you are involved in an accident with a driver who doesn’t have insurance or if you are the victim of a hit-and-run incident.

Direct Compensation - Property Damage (DCPD)

This type of vehicle insurance in New Brunswick allows you to claim damages from your own insurer, even if another driver is at fault. This covers damage to your vehicle, its contents, and loss of use, as long as someone else caused the accident.

A Guide to Purchasing Car Insurance in New Brunswick

Unlock the best rates for insurance in three simple steps:

Fill Out Our Form

Begin by completing our straightforward online form with details about yourself and your vehicle. This will allow us to generate a personalized car insurance quote based on your specific situation and needs.

Customize Your Policy

Review and adjust your coverage options to match your preferences and budget. Choose from various add-ons and enhancements to ensure your policy provides the protection you require.

Complete Your Application

After you have finalized the details of your policy with your broker, simply sign your digital insurance application and you’ll be ready to hit the roads of New Brunswick in no time.

What Factors Impact New Brunswick Car Insurance Quotes?

Several factors can influence the cost of your car insurance in New Brunswick. Understanding these elements can help you make informed decisions and potentially lower your insurance costs:

Your insurance premium can vary based on the location where you live. Areas with higher traffic density or higher rates of accidents and vehicle theft may result in higher insurance costs.

The number of drivers on your policy can influence your insurance costs. If someone in your home requires regular access to your car, they will need to be listed as a driver on your policy.

A clean driving record with no recent accidents or traffic violations generally helps you maintain lower insurance premiums. On the other hand, a history of accidents or infractions will likely increase your rates.

Your previous insurance history, such as any claims, plays a role in setting your current rates. A history with limited or no claims can help keep your premiums lower.

The kind of vehicle you drive significantly affects your insurance premium as insurers consider factors such as the vehicle’s safety features, repair costs, and likelihood of theft when determining your rates.

Your driving frequency and what you use your vehicle for can affect your insurance rates. Vehicles used for commuting or business purposes may have different premium rates compared to those used only for leisure.

The extent of coverage you select for your policy can affect the cost. Comprehensive and high-limit coverage options typically come with higher premiums but provide more protection. While basic coverage options may be more affordable, they leave you exposed to more financial risk.

Ways to Save on Auto Insurance in New Brunswick

By using a few strategic approaches, you can unlock significant savings on your premiums and keep more money in your pocket. Here are some effective ways that can help you secure the best rates possible:

Consult a Local Insurance Broker

Partnering with an insurance broker in New Brunswick can simplify the process of finding the right coverage. They’ll compare various policies and rates from different insurers to help you secure the best deal tailored to your needs.

Combine Your Insurance Policies

Consider bundling your auto insurance with your home insurance in New Brunswick. This approach often leads to lower rates and streamlines your insurance management by having multiple policies with one provider.

Equip Your Vehicle with Winter Tires

Installing winter tires can boost your safety on New Brunswick’s icy roads. Many insurance providers offer discounts for vehicles with winter tires, as they help reduce the likelihood of accidents in challenging winter conditions.

Explore Available Discounts

Ask your insurance provider about potential discounts you might qualify for. Factors such as completing a defensive driving course or installing an anti-theft device could make you eligible for reduced premiums.

Maintain a Safe Driving Record

Being a safe driver can prevent at-fault accidents and traffic violations. This will allow you to keep a clean driving record, which can help you access better rates and avoid a premium increase.

Reduce Your Mileage

Cutting back on how much you drive can help lower your insurance premiums. Consider carpooling, utilizing public transportation, or working remotely to decrease your vehicle’s usage and reduce your overall insurance costs.

Frequently Asked Questions About Auto Insurance in New Brunswick

The price of car insurance in New Brunswick can vary widely due to factors like driving history, vehicle type, and coverage levels. Each policy is tailored to individual circumstances, meaning your premium will be influenced by your unique personal risk profile and local conditions.

We’ll access quotes from various insurance providers so that you can review and select the most suitable option for your needs.

Absolutely! Getting a quote before purchasing a car is a smart move. This allows you to compare the insurance costs associated with various vehicles, helping you make a well-informed decision and stay within your budget.

It’s best to add a new driver to your policy as soon as they begin using your vehicle regularly. This ensures that they are properly covered in case of an accident and prevents any gaps in your insurance coverage or issues during the claims process.

Adjustments to your policy are straightforward and can be made at any time. Whether you need to modify coverage, adjust your annual mileage, add a driver, or update vehicle information, a BIG broker will help you make the necessary updates.

Experience the BIG Difference

Navigating the world of insurance can be overwhelming, but BIG makes that experience seamless and straightforward.

Our dedicated team of brokers takes the complexity out of insurance and will find customized coverages that meets your needs. Discover how easy and stress-free insurance can be with BIG on your side!